An amalgamation occurs when two or more corporations merge to form a new corporation. Legally and for tax purposes, an amalgamation transfers the assets and liabilities of the predecessor corporations to the newly amalgamated corporation without tax consequences, which will be discussed in detail later. The shareholders of each predecessor corporation become the shareholders of the amalgamated corporation. The analogy often used is that amalgamation resembles two streams converging to create a larger river.

Therefore, an amalgamation is an attractive tool for reorganizing or merging corporations. While the concept seems straightforward, numerous corporate law requirements must be met to proceed with an amalgamation.

Amalgamate an Ontario Corporation

Ontario Business Corporations Act (OBCA) sections 174-179 contain the amalgamation provisions.

Amalgamate a Canadian Corporation (Federal corporation)

Canada Business Corporations Act sections 181-186 cover the requirement for amalgamation of corporations.

Both acts provide comparable provisions regarding amalgamation. A federal corporation cannot amalgamate with an Ontario corporation; one of the corporations must be continued under the other statute as a pre-condition for the amalgamation. This requires filing Articles of Continuance.

Both Ontario and federal corporations offer two types of amalgamations: short-form and long-form. In both types, it is possible to amalgamate more than two corporations at a time.

Short Form Corporate Amalgamation:

A short-form amalgamation is relatively simpler as it does not require an amalgamation agreement. Approval from the directors through a resolution suffices without needing shareholder approval.

There are two types of short-form amalgamation.

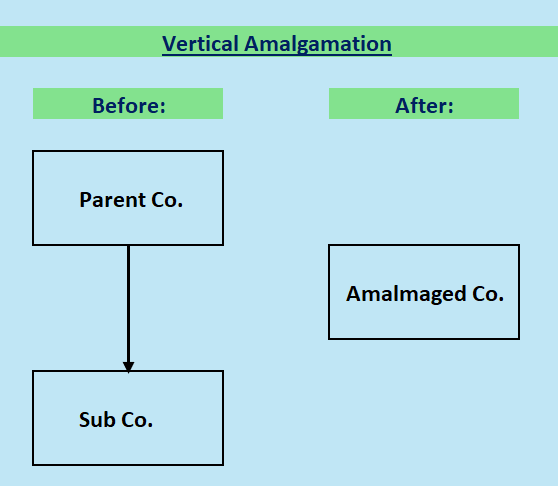

- Vertical Amalgamation –A vertical amalgamation involves a holding corporation (a parent company) and one or more wholly-owned corporate subsidiaries. On completion of amalgamation, the articles of amalgamation must match the articles of the amalgamating holding corporation. The only exception to this is the name, which can be different.

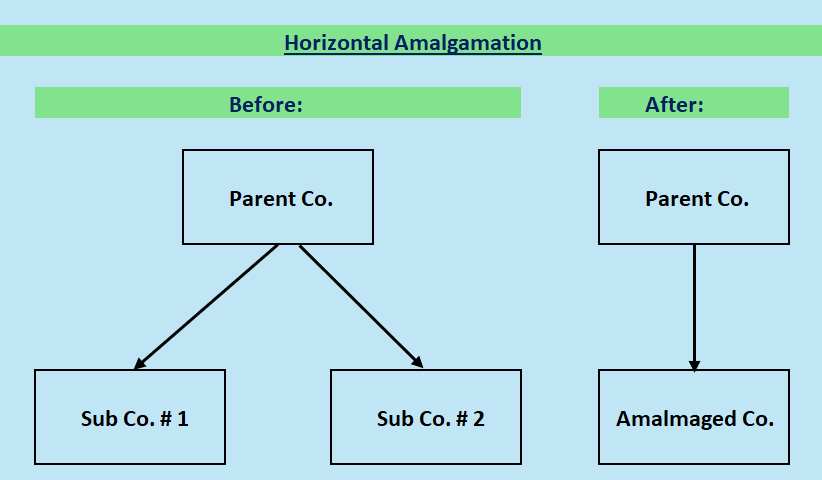

- Horizontal Amalgamation – In a horizontal amalgamation, multiple wholly-owned subsidiaries of the same holding corporation (the parent corporation) are merged. After the amalgamation is complete, the shares of all subsidiaries except one are cancelled. The articles of amalgamation of the new corporation must be the same as the articles of the amalgamating subsidiary corporation whose shares are not cancelled. The one exception is the name, which can be different.

Long Form Corporate Amalgamation

A long-form amalgamation is any amalgamation that is not considered short-form, including Triangular Amalgamation. Each participating corporation must sign an amalgamation agreement, which the shareholders must approve at a meeting.

Triangular Amalgamation: In a triangular amalgamation, instead of receiving shares in the amalgamated corporation, the shareholders of the amalgamating corporations receive shares in the parent corporation of the amalgamated corporation.

The agreement outlines, among other details, the terms and conditions under which the shares of the predecessor corporations are converted into shares of the new corporation. This agreement must be approved by shareholders entitled to vote from each predecessor corporation, including each class or series of shares with voting rights.

Under Canada’s Income Tax Act, amalgamation is categorized into two main types:-

- “Qualifying amalgamations,” which meet conditions under section 87, allowing Canadian corporations to merge on a tax-deferred basis.

- Other amalgamations are “statutory amalgamations” or “non-qualifying amalgamations.”

Criteria for Section 87 Tax-Free Rollover

- The “predecessor corporations” must be taxable Canadian corporations.

- All of the shareholders of the predecessor corporations must receive shares of the new amalgamated corporations.

- The Shareholders must only receive shares in the amalgamated corporation (no other considerations are allowed)

- The original shares held by the shareholders of the predecessor corporation must be held to earn capital gains rather than business income.

- All assets and liabilities of the predecessor corporations (other than intercompany balances) must be transferred to the newly amalgamated corporation.

Under Section 87, the parent does not need to own 90% or more of the shares of the subsidiary. Section 88 can only be used when a parent and a sub are merging and when the parent owns 90% or more of the shares of the Sub to achieve similar results.

Other Important considerations of Amalgamation

Deemed Year End

There is a deemed year-end one day before the amalgamation for all predecessor corporations. The newly amalgamated corporation begins its taxation year on the day of the amalgamation and can choose any year-end, which does not have to correspond to that of the predecessor corporations.

As a result of the deemed year-end (a short tax year), the small business deduction limit of $500,000, as well as the capital cost allowance (CCA), will be prorated. Similarly, non-capital losses age by one taxation year as the shortened tax year will count as one carry-forward year.

Loss Utilization

In a vertical amalgamation between a parent and a 100% owned subsidiary, losses realized by the amalgamated corporation (after the amalgamation) can be carried back against the income of the former parent corporation, as the amalgamated corporation is considered to be the continuation of the predecessor corporations for the purposes of losses.

In other cases, since non-capital losses and net-capital losses flow through to the amalgamated corporation, they can be carried forward against the amalgamated corporation’s income but not carried back.

Effect on Shareholders

If all the criteria of Section 87 are met, the shareholder is deemed to dispose of their shares in the predecessor corporation at their adjusted cost base (ACB) and acquire shares in the newly amalgamated corporation at the same ACB, with no tax consequences.

Continuation of Each Business:

Under subsection 87(2.1), the new corporation is considered to be the same as and a continuation of each predecessor corporation for income tax purposes. Courts have ruled that amalgamated entities do not eliminate the predecessor entities but rather continue them, meaning that all the assets and liabilities of the amalgamating corporations carry over to the amalgamated corporation.

Bump-up of the Value of Non-Depreciable Properties of a 100% Owned Subsidiary

In an amalgamation where a parent company owns 100% of its subsidiary’s shares, the newly amalgamated company can increase the adjusted cost base (ACB) of any non-depreciable capital properties (such as shares, land, or partnership units) that the subsidiary has held continuously since the parent last gained control.

This CRA policy allows for a bump-up in the ACB because the parent company likely paid a premium for the subsidiary’s shares compared to the subsidiary’s net asset value (book value) at the time of purchase. Consequently, the amalgamated company is permitted to adjust the ACB of non-depreciable capital properties to reflect this difference.

These “bump-up” transactions and their associated formulas are highly complex and should be thoroughly reviewed by a CPA.

Why Amalgamation?

Given the legal complexities, requirements, and professional fees associated with amalgamation, it’s worth asking why one might pursue it. Amalgamation is a valuable tax planning tool and can be used for various reasons, including:

- Simplify Business Structure: If you own multiple corporations, amalgamating them can streamline your business structure.

- Reduce Administrative Costs: Amalgamation may lead to a simplified share structure and eliminate redundant corporations, reducing compliance and administrative and corporate tax filing costs.

- Consolidate Losses: By amalgamating, you can consolidate the group’s losses, enabling the deduction of one corporation’s losses against the income of another.

- Avoid Tax Consequences: It allows for the transfer of assets (and liabilities) between corporations without disposing of the assets, thus avoiding potential tax consequences under the Income Tax Act, Land Transfer Tax Act, or Part IX of the Excise Tax Act regarding GST/HST.

- Achieve Acquisition Goals: Amalgamation can facilitate the acquisition of another corporation and help achieve corporate or tax objectives.

As evident from above, amalgamation (or merger) is a crucial corporate tax planning tool. However, it requires compliance with various corporate and tax laws, including the Ontario Business Corporations Act, the Canada Business Corporations Act, the Income Tax Act, and the Excise Tax Act (HST/GST), etc. Given the complexity of this area of corporate law, professional expertise is essential. It is highly recommended that you seek professional advice to determine if amalgamation is the right strategy for you and understand its implications.

If you are a business owner seeking assistance with corporate structure, asset transfers between corporations, buying a business or corporate tax planning, please contact the Source Accounting Team at 647-930-8130. Our experts will be happy to assist you.

Source Accounting Professional Corporation (CPA) is a full-service accounting firm in Mississauga, dedicated to small and medium-sized businesses, providing tax preparation, corporate tax filing, accounting, bookkeeping services, payroll solutions, etc. If you are in process of buying an existing busienss and need assistance, please call for consultation or send us an email. We provide services to our clients across Ontario (Mississauga, Toronto, Oakville and beyound).

Disclaimer: The above contents are provided for general guidance only, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. It does not provide legal advice, nor can it or should it be relied upon. Please contact/consult a qualified tax professional specific to your case.

![Heaader1SourceAccount[3148]](https://sourceaccounting.ca/wp-content/uploads/2021/11/Heaader1SourceAccount3148-2048x289.png)