What are the benefits of Incorporation?

This is the most common question asked when anyone starts a business or when a business grows, and owners look to adapt business structure. As for any tax issues, the specific answer is different for each case, however, generally one should ask the following questions when choosing a business structure (incorporating vs proprietorship):-

- Are you looking to cut your tax from 53.53% (the highest personal marginal tax rate in Ontario) to 12.2%?

- Is your business earning more than your and your family needs?

- Are you looking for opportunities to split income with family members?

- Do you want to save money for retirement?

- Are you considering passing on the business to your family members?

- How important is the continuation of business in case you leave (because of death or otherwise) and ease of transfer of ownership?

- Are you expecting to sell off your business with a profit and want to avoid all or part of capital gain tax?

Incorporating a business offers various advantages, opens the doors to various tax planning opportunities, and addresses most of the questions discussed above.

Below I will discuss various advantages of incorporating a business that may be applicable to you in different stages of your life cycle. There are various types of corporations in Canada, but our discussion will be focused on the Canadian Controlled Private Corporation (CCPC) since most small and medium-size corporations would fall in this category.

What is a CCPC?

A Canadian corporation is CCPC if it is a private corporation incorporated in Canada that meets the following conditions: –

- it is not controlled by a public corporation; and

- It is not controlled by non-residents; and

- Any class of shares is not listed on designated stock exchanges.

You will see below that the CCPC qualifies for various preferential tax treatments, which other corporations don’t.

Now let us discuss the key advantages of incorporating a business: –

1) Limited Liability

While a proprietor is personally responsible for all liabilities of the business, the shareholder of a corporation is not. Limited liability is a form of legal protection for a shareholder/owner that prevents individuals from being held personally responsible for their company’s debts. In other words, your risk is limited to the amount invested in the corporation.

2) Separate legal entity

A corporation is a separate legal entity from the shareholder. It can own assets, insurance, enter into a legal contract, make an investment, etc. It files its own tax return and owes/pays its own income tax, HST, and payroll taxes.

Proprietorship continuation depends on its owner and comes to an end at the owner’s death. A corporation is independent of its shareholder. A shareholder can transfer his shares to anyone without affecting the corporation or its operations.

3) The Small Business Deduction Limit

The main advantage of being a CCPC is that it qualifies for the small business deduction, which reduces both federal and provincial tax rates. A CCPC currently pays income-tax @ 12.2% (depending upon province) on its active business income up to $500,000, called the business limit. Other corporations pay the general tax rate @ 26.5%.

However, there are various restrictions on the business limit.

a) Association rules:

all corporations under common control must share the business limit. This means that if you own and control various corporations (either yourself or with someone else) all corporations can enjoy a reduced tax rate up to a total income of $500,000 collectively. Association rules are very complex, make sure to discuss them with a qualified tax professional.

b) Taxable capital limit:

If a corporation’s taxable capital in Canada (together with the associated corporation) exceeds $10 million, the business limit will start reducing and once it exceeds $15 million, it no more qualifies for the small business deduction.

c) Passive income rules:

Tax rules apply a higher tax rate on investment income earned inside a corporation. But new rules (starting from 2019) further penalize a CCPC by charging a higher rate even on active business income if it earns investment/passive income over a threshold.

The small business deduction limit will reduce for a CCPC earning over $50,000 in investment income in a year – a reduction of $5 for every $1 of investment income. Accordingly, a CCPC does not qualify for any small business deduction once it earns an investment income of $150,000 and pays tax @ 26.5% instead of 12.2%.

An example of passive income includes interest income, capital gains, dividends, rents, royalties, etc.

d) Exemption from passive investment income rule:

There are few exemptions from the above-discussed passive income rules. For example, dividends received from a connected corporation are excluded from the definition of investment income. Similarly, if more than five employees are engaged in rental income then rental income will be classified as active business income.

Similarly, if more than five employees are engaged in rental income, then rental income will be classified as active business income.

4) Tax deferral

The Canadian tax system is based on the “integration” concept, meaning that everyone pays the same (or almost the same) tax regardless of how income is generated. For example, if you earn income directly in your name (as a proprietor) or inside a corporation, you would end up paying approximately the same tax. However, income earned inside a corporation is taxed in two stages. First at a corporate level and second when the income is passed on to the shareholders in the form of salary or dividend.

This creates a great tax deferral (not avoidance) opportunity, by retaining the income inside the corporation. This way you pay only low corporate tax and delay paying personal taxes till income is distributed to shareholders. However, this is practically possible when the income generated inside a corporation is more than the personal needs of the owner. The following example will illustrate, how Mr. John’s cash flow will impact if he earns the same income under proprietorship vs corporation.

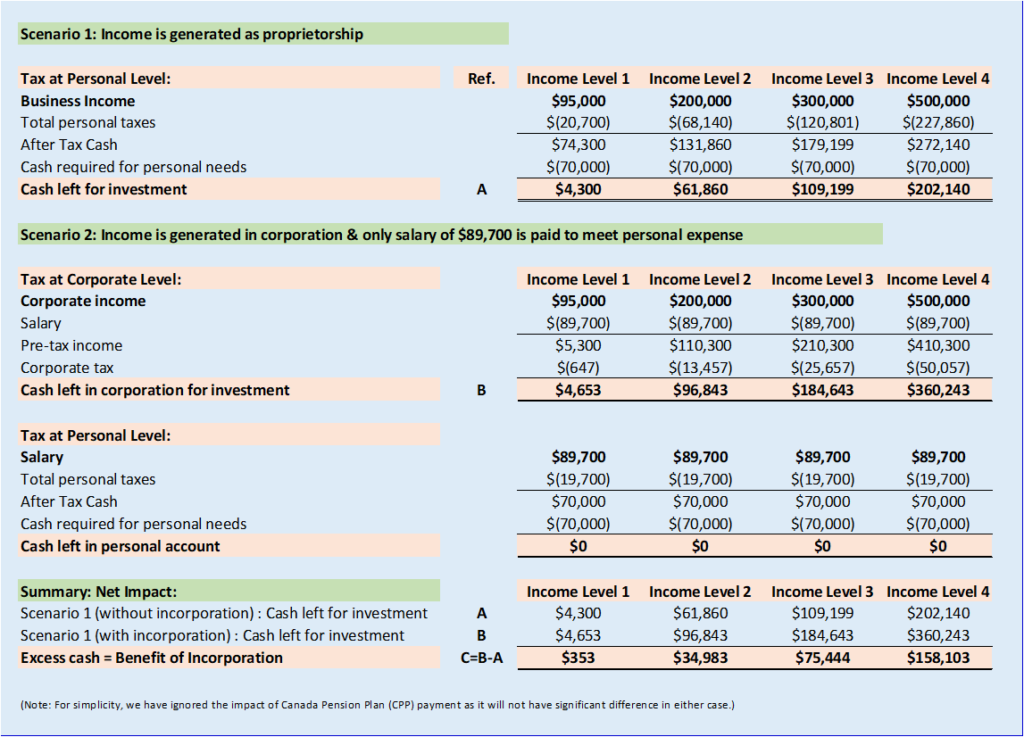

For this illustration, we have assumed that: –

- Mr. John is a single individual living in the province of Ontario.

- He needs $70,000 (after tax) annually to meet his personal /family needs.

- Business income is arrived after deduction of allowable business expense i.e., net income.

In the below table, we have calculated the excess cash left to Mr. John after meeting his personal living expense at four different income levels under two different scenarios, i.e. proprietorship (labeled as Scenario 1) and corporation (labeled as Scenario 2).

As can be seen from the above table, at the first income level, i.e. $95,000, using the corporate structure will result in net excess cash of only $353 (lined referred “C”), the benefit of incorporation. However, this benefit of incorporation is too small at this level of income. In fact, other costs related to incorporation will over-weigh this saving.

But as the income level increases, we see the benefit of incorporation keeps magnifying. The main reason is the use of tax deferral opportunity of incorporation, i.e. Scenario 2. Despite increased income, Mr. John is only taking a salary of $89,700, to make sure he receives an after-tax income of $70,000 for his personal use. The balance income he is retaining inside the corporation. This income inside the corporation is only subject to a low corporate tax of 12.2%, and he is avoiding the second layer of personal taxes, which can be as high as 53.53% (the highest personal tax rate in Ontario). Mr. John will use the money saved from delaying taxes for his business expansion.

5) Income splitting:

Income splitting is a process of passing on income to your family members (spouse, kids, and parents) with low tax brackets. If family members work for the business, a salary that is “reasonable” (same as paid to other employees) can be paid.

The second option for income splitting is through dividends to family members. The Tax on Split Income (TOSI) rules make dividend income sprinkling exceedingly difficult. As per TOSI rules, the dividend will be subject to the highest rate of personal tax, with restrictions on tax credits, unless an exception is available.

Generally, the following dividend payment to family members is exempt from TOSI rules if the family member is a shareholder of the corporation and is:-

- At least 18 years of age and actively involved in the business (working an average of 20 hours a week or more); or

- At least 25 years of age and hold shares that represent at least 10% of the corporation (in votes and value), and less than 90% of the corporation’s income is earned from the provision of service; or

- 25 years of age or older, a dividend representing a reasonable return on their contribution to the business; or

- Spouse (or common-law partner) with age 65 or older.

As a cautionary note TOSI rules are complicated, please seek professional advice.

6) The flexibility of owner’s remuneration:

Incorporating gives the shareholder flexibility of different payment options including salary, dividend, a mix of a salary and dividend, etc.

We have discussed these options in detail in our other article, “Withdrawing money from Canadian corporation: What you need to know!”

7) Lifetime capital gains exemption limit:

Another major advantage of a CCPC is that when you sell your corporation, and you have a capital gain, you can claim a lifetime capital gain exemption limit. The lifetime capital gain limit for 2021 is $892,218 (indexed to inflation). So basically, that means that you don’t have to pay any capital gain tax up to this amount.

This benefit is only available to shareholders of “qualified” Small Business Corporation (SBC).

What is an SBC?

A corporation is an SBC:-

1) It is CCPC; and

2) All or substantially all of its assets are used in an active business carried on primarily in Canada. As per CRA’s interpretation, that means 90% of assets, based on the fair market value at the time of sale;

To be “qualified” SBC, the corporation needs to meet additional two conditions:

3) More than 50% of its assets (based on the fair market value) are used in an active business carried on primarily in Canada throughout the 24-month period immediately before the sale; and

4) The shares of the corporation have not been owned by anyone other than you or someone related to you during the 24-months period before the sale.

8) Allowable Business Investment Loss (ABIL):

If an SBC corporation fails, any capital loss can be used as ABIL i.e. can offset other types of income in your tax return. Otherwise, other capital losses can offset capital gains only. This is yet another incentive to own a small corporation which is an SBC.

9) Estate freeze:

On death, you are “deemed” to have disposed of all your capital assets (including the share of a corporation) at their “current fair market value” and your estate must pay capital gain tax before shares can be transferred to your children. If the value of the shares has increased significantly it may create a cash flow problem for the surviving family.

One solution is to “rollover” assets on the existing cost base (transfer without triggering any capital gain) to the spouse; however, the spouse would face the same issue when transferring it to the kids ultimately.

A better solution is the estate planning technique called “estate freeze”. In brief, you “freeze” the value of your shareholding to the current value of the company’s share (by exchanging your common shareholding with the preferred share with a fixed redemption value equal to the current value of the company.) And you make your family members (commonly children) subscribe to new common shares with a nominal value, say $100. Since now, you own preferred shares with fixed redemption value, this allows any future growth of the company value to accrue to new common shares held by other family members. Preferred shares can be voting shares to allow you to maintain control of the corporation.

Accordingly, at your death, only preferred shares are deemed to have been disposed of, the value of which was frozen when the estate freeze was executed, not the full company.

Disadvantages of incorporation:

Of course, there are some drawbacks as well for the corporation. In most cases, the benefits of incorporation outweigh the disadvantages, but it is necessary to know them.

- Incorporating a company is costly as compared to proprietorship. Moreover, bookkeeping and tax filing are also expensive for a corporation in comparison to a sole proprietorship.

- Since you and the corporation are a separate entity, any loss inside a corporation cannot be offset with other personal income. Therefore, if you see the possibility of initial losses, you may want to delay the incorporation of the business until it turns profitable.

- A corporation requires additional documentation, administrative work, and government filing.

- Personal service business (PSB) rules: PSB means an individual provides services on behalf of the corporation (an “incorporated employee”) or a person related to the incorporated employee. Basically, if one provides service through a corporation and if not for the corporation, one would be considered an employee of the entity to which one provides service. PSB is subject to the highest flat federal tax rate of 33%. Furthermore, deductions claimed by PSB are limited to salaries and benefits paid to the incorporated employee. An Individual, providing service under a corporation, should be careful not to be classified as PSB by CRA.

Conclusion:

There are various advantages of incorporating a business. However, careful planning is required. Tax laws are complicated and their application to each situation is different. It is highly recommended to consult a tax professional while making these decisions. Our professionals, at Source Accounting Professional Corporation, CPA, are ready to guide and help you. Call for a free initial consultation.

If you have any questions or any other tax and accounting issues, please feel free to reach out to Source Accounting. Source Accounting is an accounting firm in Mississauga, dedicated to small and medium-sized businesses, providing tax, accounting, bookkeeping, payroll solutions. And if you find this post helpful, please let us know in your comments.

Disclaimer: The above contents are provided for general guidance only, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. It does not provide legal advice, nor can it or should it be relied upon. Please contact/consult a qualified tax professional specific to your case.

![Heaader1SourceAccount[3148]](https://sourceaccounting.ca/wp-content/uploads/2021/11/Heaader1SourceAccount3148-2048x289.png)